-40%

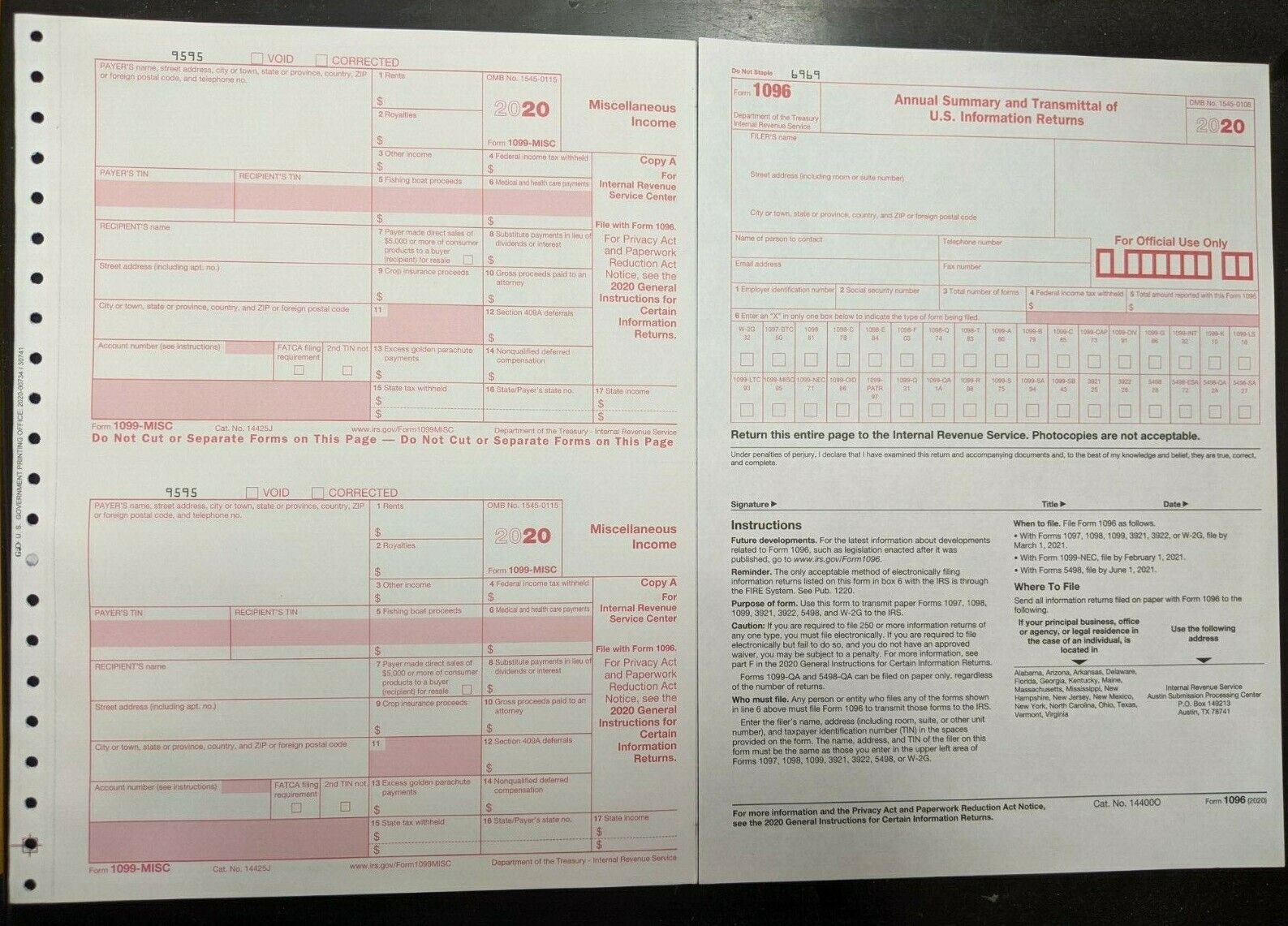

IRS Tax Forms 14) 1099-MISC Miscellaneous Income & 3) 1096 Transmittal Year 2020

$ 5.78

- Description

- Size Guide

Description

Three (3) 1096-Transmittal Forms for Tax Year2020

and

Fourteen (14) 1099-MISC Tax Forms for Tax Year

2020 (these are carbonless copy forms. Each sheet has two 1099-MISC

forms. Total 12 sheets).

IRS approved forms. Forms are

carbonless.

These forms are non-continuous feed, non-laser/non inkjet forms, . They can only be used with hand written or typewriter only.

Each form has five parts to it

Copy A - for the Internal Revenue Service Center

Copy 1 - for State Tax Department

Copy B - for the recipient

Copy 2 - for the recipient's state income tax return, when required

copy C - for the payer

These forms will be mailed unfold, flat in an envelope. FREE USPS shipping.

These forms are non-continuous feed, non-laser/non inkjet forms, . They can only be used with hand written or typewriter only.

File this form for each person to whom you have paid during the year:

at least in royalties or broker payments in lieu of dividends or tax-exempt interest;

at least 0 in:

rents;

services performed by someone who is not your employee;

prizes and awards;

other income payments;

medical and health care payments;

crop insurance proceeds;

cash payments for fish (or other aquatic life) you purchase from anyone engaged in the trade or business of catching fish;

generally, the cash paid from a notional principal contract to an individual, partnership, or estate;

payments to an attorney; or

any fishing boat proceeds,

In addition, use this form to report that you made direct sales of at least ,000 of consumer products to a buyer for resale anywhere other than a permanent retail establishment.

5.4 ozs